11 Dec

Why schedule intelligence is just as critical as fare intelligence for airline revenue teams

Introduction: More Than Just a Fare Game

When we talk about airline competition, the focus almost always lands on fares. Revenue managers spend countless hours monitoring competitor price points, adjusting their own strategies, and deploying promotions to stay attractive in the market. But there’s another, quieter battlefield that often dictates whether those fares will even convert: schedules.

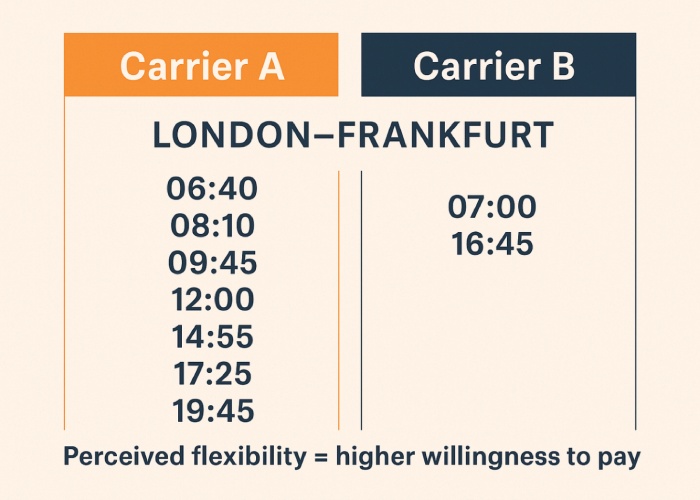

Competitors don’t just compete on price — they compete on when and how often they fly. Departure times, frequencies, and connection options can be as decisive in a traveler’s booking choice as the fare itself. Yet, schedule intelligence is frequently treated as a secondary dataset. In reality, it can mean the difference between leading the market or chasing it.

Why Schedules Shape Demand More Than We Realize

Or consider a leisure traveler booking a trip from New York to Cancun. A 10 a.m. nonstop departure means a full afternoon on the beach, compared to a 7 p.m. arrival that wastes the first day. Even at a slightly higher fare, the “better-timed” option often wins.

These examples highlight why schedules aren’t just operational details. They actively shape demand, influence willingness to pay, and often explain why some carriers can sustain higher average fares despite aggressive competition.

The Blind Spot in Revenue Management

Traditionally, revenue management teams have operated with a fare-first mindset. Monitoring tools, dashboards, and competitive benchmarks are primarily price-driven. Schedules are acknowledged — but often in isolation, sitting with network or operations teams rather than integrated into pricing decisions.

This creates a blind spot. For example:

- Price drops that don’t move the needle. If your competitor quietly added two extra morning frequencies, their market share will rise regardless of your fare cuts.

- Sudden shifts in demand curves. A new competitor entering with a better-timed departure can compress your yields, even if their base fares aren’t lower.

- Overestimating parity. Two airlines may show identical lowest fares on an OTA, but the one offering a better arrival time effectively wins the comparison.

Revenue managers who rely solely on fare intelligence risk missing the structural reasons why demand is shifting.

How Competitors Use Schedules Strategically

Airlines have long known that frequency and timing are levers of competitive advantage. Consider these tactics:

- Flooding Frequencies on High-Yield Routes

- Day-Part Targeting

- Seasonal Adjustments

- Strategic Connections

Each of these moves shifts the market dynamic — sometimes more dramatically than a fare cut.

Why Schedule Intelligence Is Critical for Pricing Teams

To fight smarter in pricing wars, revenue managers need more than fare snapshots. They need to see schedules as a layered competitive advantage. Here’s why:

- Fare elasticity depends on timing. A 6 a.m. flight may not need deep discounting to sell to business travelers, while a mid-day flight might. Without schedule context, pricing decisions can misfire.

- Frequency drives willingness to pay. Airlines with higher frequencies can sustain stronger pricing power. Competitors with fewer flights often over-discount, thinking they’re uncompetitive on fares alone.

- Schedules explain anomalies. If a competitor consistently maintains higher load factors despite similar fares, the answer often lies in better-timed departures or stronger connections.

- Integrated view drives smarter forecasting. By merging fare and schedule intelligence, forecasting models can predict not just what travelers will pay, but when they’re likely to book.

Using Data to Decode Schedule Power

This is where tools like AirGain’s Flight Schedules feature play a silent but critical role. Revenue teams can:

- Compare competitor frequencies and aircraft types on specific O&Ds.

- Track seat counts to see where capacity is shifting.

- Identify schedule patterns by weekday or time-of-day.

- Cross-reference fares with schedules to see why certain competitors consistently outperform.

For example, if Carrier A consistently undercuts fares but Carrier B maintains load factors, schedule analysis may reveal that Carrier B’s departure times align better with peak demand. This insight prevents over-discounting and helps teams defend yield.

Case Study: The Dubai–Delhi Corridor

On the Dubai–Delhi route, multiple carriers compete aggressively. Carrier X launches three new evening departures, targeting labor traffic returning after work. Carrier Y responds with fare cuts, but bookings still drift to Carrier X because timing trumps price.

Only when Carrier Y adjusted its morning and late-night flights to match demand patterns did it regain share — even though its fares were higher than before.

The lesson: schedule intelligence is not reactive. It’s predictive. It shows where demand will flow, often before fares adjust.

The Future: Schedules + Fares = True Market View

The future of competitive intelligence isn’t fare or schedule — it’s fare + schedule, analyzed together. With Gen-AI powered analytics, revenue managers can now:

- Automatically flag when competitors add new frequencies.

- Simulate demand shifts when schedules change.

- Benchmark not just against the cheapest fare, but against the best-timed itinerary.

This integrated intelligence is what transforms pricing teams from reactive fare matchers into proactive revenue strategists.

Conclusion: Winning the Silent War

Airline pricing wars will always make headlines about “fare battles” and “price cuts.” But the smartest revenue managers know that fares are only half the story. Schedules — the silent shapers of demand — often decide who wins before price even enters the equation.

By embedding schedule intelligence into pricing workflows, airlines can:

- Anticipate competitor moves earlier.

- Protect yields on time-sensitive departures.

- Balance frequency with profitability.

- And most importantly, align pricing decisions with how passengers actually choose.

In today’s competitive landscape, ignoring schedules is no longer an option. The real winners in pricing wars will be the ones who see beyond fares — and master the silent role of schedules.